Former Santa Monica Mayor Pam O’Connor has submitted 4,156 signatures to the City Clerk to place a measure on the fall ballot that would exempt multi-family housing from the city’s increased transfer tax for larger property sales that was approved by voters in 2022.

Measure GS placed a tax on any real estate transaction of more than $8 million. It was estimated by the city that it would raise $50 million a year to support new affordable housing, local schools and homelessness prevention. In its first year, it raised $17 million. A similar measure in Los Angeles, passed in the same election, has also underperformed.

But wait…didn’t the City Clerk say that over 7,000 signatures would be needed for the measure to qualify? O’Connor and other supporters of the new ballot measure are contending the clerk is wrong, because a state law makes it clear that a lower threshold is needed to place a measure on the ballot to lower or remove a tax than it is to raise one.

The city has said that the number of valid signatures required is 10 percent of the City’s registered voters, roughly 7,000 valid signatures. Proponents of the new ballot measure say state law supersedes that and only 5% of the number of voters that voted in the last gubernatorial election are needed, which in this case is 1,978 signatures. The ballot measure proponents have said they will sue the city if it tries to enforce the 7,000 signature requirement.

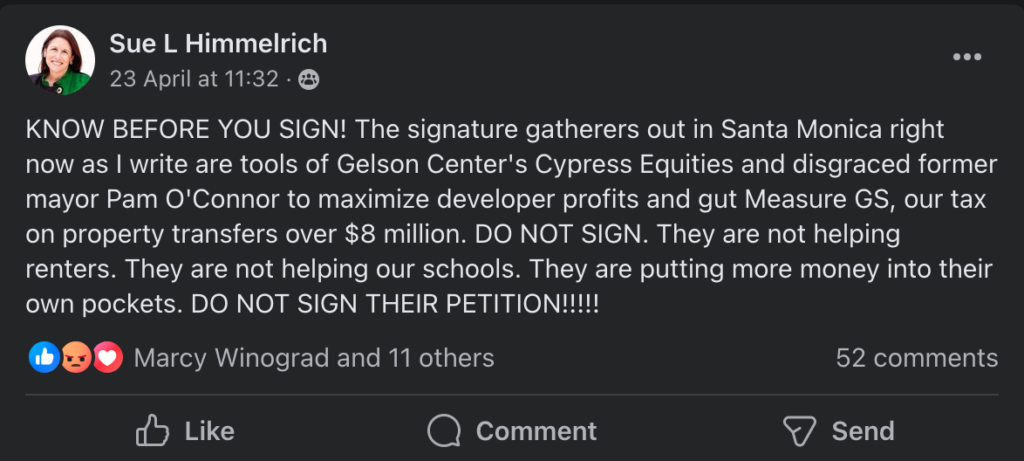

Even before the measure has reached the ballot, it is already proving controversial. Another former Mayor, Sue Himmelrich has aggressively campaigned against the measure in the press and social media. Posts, such as the one seen below, urge people not to sign the signature and accuse the measure’s sponsors, including O’Connor and Cypress Equity Group, of trying to “gut” the measure to increase their profit margins.

Both political organizations that supported GS (Santa Monicans for Renters Rights, the Santa Monica Democratic Club) and those that were opposed to it (the Santa Monica Coalition for a Livable City) have come out against the new measure.

But the numbers show that Measure GS isn’t working as planned and that it may be having an unintended impact on the city’s ability to produce affordable housing.

But while Measure GS is not raising as many funds as were promised, it may also be hurting local housing production. Measure GS raised the transfer tax by $56 per $1,000 for Santa Monica properties that sell for $8 million or more. While this may not seem like a large amount, according to proponents of exempting multi-family units it obliterated their profit margins making it very difficult to find investors for any development not grandfathered in before GS was passed. By eliminating that new transfer tax, it would spur new development.

In 2022, How Will the Measure ULA Transfer Tax Initiative Impact Housing Production in Los Angeles?, a study by UCLA’s Lewis Center for Regional Policy analyzed Los Angeles’ Measure ULA. The report found that only a small percentage of potential new units would be impacted, but that the cost of replacing these units would sharply cut into the amount of money generated by Los Angeles’ measure. The author of this report, Shane Philips, now believes that new developments should be exempted from the tax, which is not quite as far as the current ballot measure but is another sign that Measures GS and ULA are going to need some sort of retooling.