In a highly unusual move, the Santa Monica Housing Commission is considering two competing reports that outline recommended strategies to tackle the city’s growing housing affordability crisis.

[pullquote align=left]

“[W]e do not believe any new market rate or mixed use development project should be approved simply because it provides new affordable housing.” – Housing Commissioner Michael Soloff

[/pullquote]Two distinct draft reports appear on the Commission’s agenda for its special Saturday meeting and while one appears to be the Commission’s primary draft report, the other was authored by Housing Commissioner Michael Soloff, who also sits on the steering committee of the city’s single most powerful political organization, Santa Monicans for Renters’ Rights (SMRR).

There are many similarities between the two reports. Both outline potential strategies to raise local public funding sources for affordable housing preservation and construction. Unlike the primary report, however, the Soloff report attempts to lay the blame for Santa Monica’s housing affordability crisis on state legislation that has eroded the city’s once stringent rent control law.

Under the 1995 Costa-Hawkins Act, state law mandated that property owners be allowed to raise rents on units to market rate rents after tenants vacated. Santa Monica’s rent control law, passed in 1979, had prohibited such rent increases.

Since Costa-Hawkins went into full effect in 1999, an average of 400 to 550 long-term rent controlled units turn over a year, renting at market rates for the first time.

While rent control has kept rents low for existing tenants, one thing rent control doesn’t address is the increased need for housing as a result of population growth and increasing demand to live in Santa Monica.

Perhaps most baffling of all is that the Soloff report is hostile to one of Santa Monica’s most successful tools for producing below market-rate rental housing. The language echoes the “community character” argument often employed by opponents to new housing.

“[W]e do not believe any new market rate or mixed use development project should be approved simply because it provides new affordable housing,” the Soloff report reads. “Development projects should be approved only when, in their own right, they make a positive contribution to our community.”

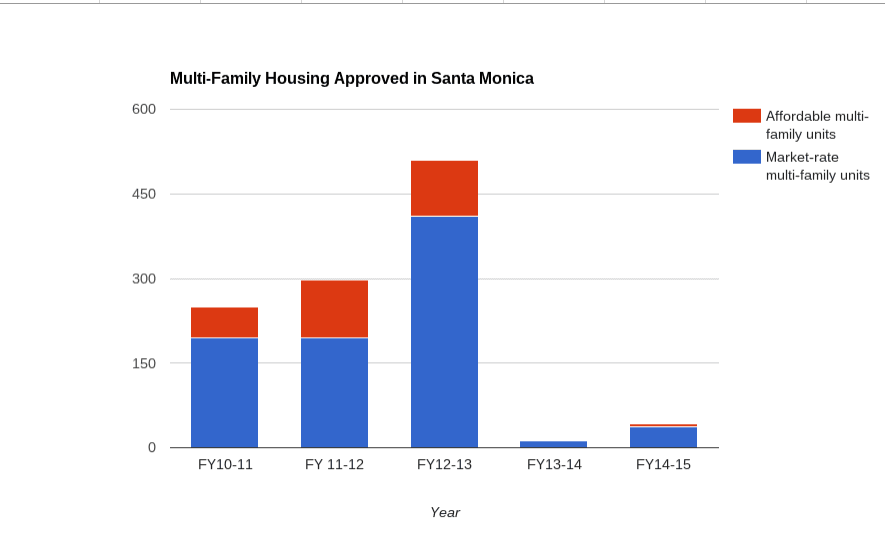

After voters approved Proposition R in 1990, the city implemented its Affordable Housing Production Program (AHPP). Santa Monica amended its charter to require that 30 percent of all new housing built in the city be rented out below market rate to households earning moderate to low income levels.

Over the last two decades, the AHPP has produced about 1,000 homes that rent to low and moderate income residents. That number would be higher if developers were able to build more units overall, since the AHPP requires that a percentage of total units be set aside for low and moderate income households, but restrictive zoning and political opposition have artificially constrained what can be built. For example, the Hines project would have included about 100 affordable homes.

Nonprofit housing developers have created the rest of the affordable units, either through building new homes or purchasing and rehabbing existing buildings.

While public funding for affordable housing construction and preservation is a necessary tool for addressing the city’s housing crisis, it is not a sufficient one. Both reports lay out strategies for generating about $15 million a year of local funding for nonprofit affordable housing developers like Community Corporation of Santa Monica. Even if the city is able to cobble together that much annually, it will likely yield only dozens, at most, of new affordable units a year.

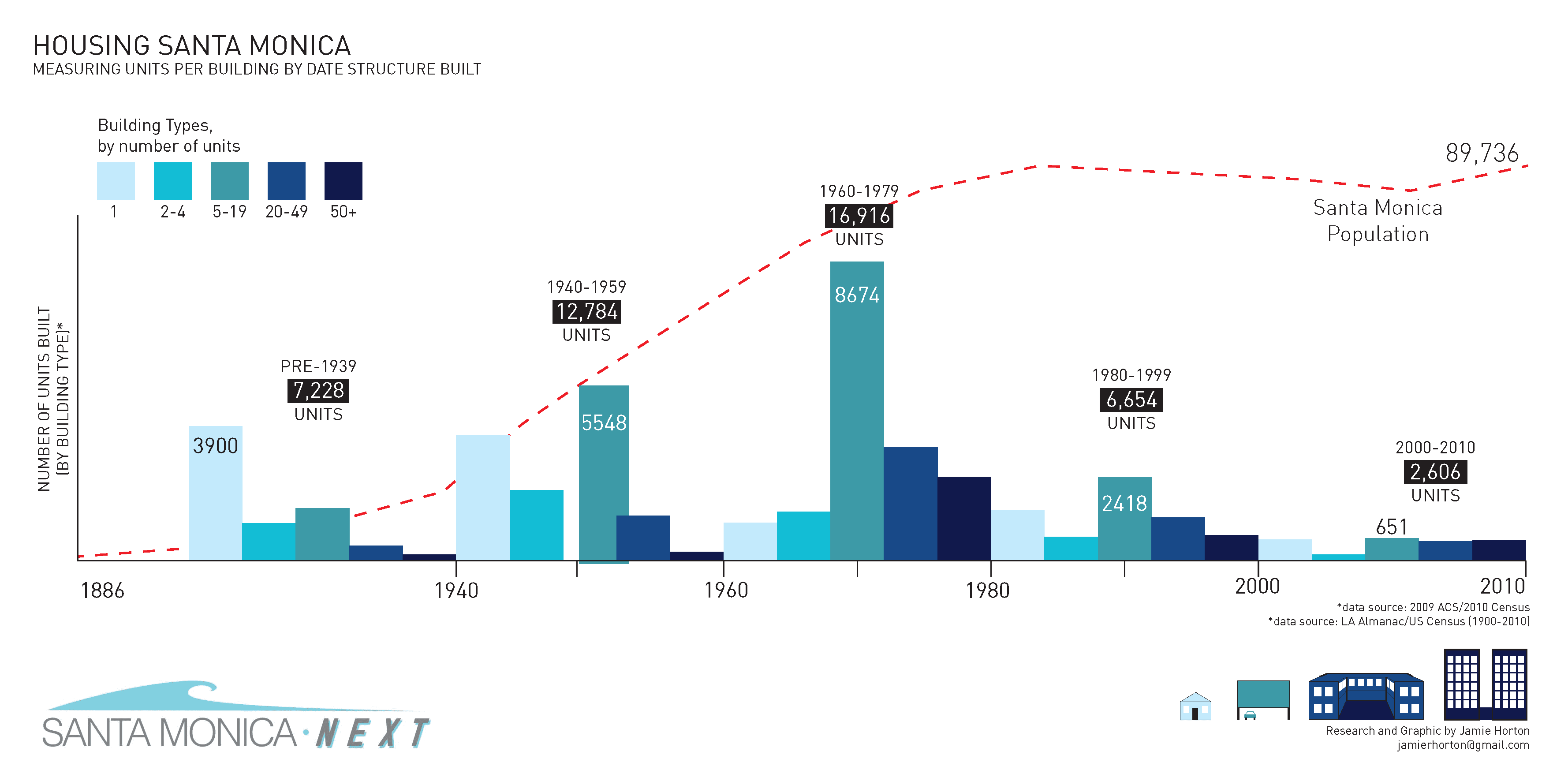

Soloff’s analysis is even more curious when you consider the the root cause of Santa Monica’s housing affordability crisis: In more than 30 years, Santa Monica has only built enough housing to allow for about a 4,100 net increase in its population.

In that time, home costs and rents have skyrocketed as demand to live in the city increased. Stringent zoning laws, an onerous approval process, and a political environment hostile to new housing all conspire to prevent Santa Monica’s housing to keep up with demand, making Santa Monica one of the most expensive places to live in Los Angeles County, a region which has the dubious distinction of being one of the most unequal in the state.

The adverse impacts of restrictive zoning are increasingly coming into the spotlight for national and state policymakers.

“[E]xcessive or unnecessary land use or zoning regulations have consequences that go beyond the housing market to impede mobility and thus contribute to rising inequality and declining productivity growth,” Jason Furman, chair of President Obama’s Council of Economic Advisers, said recently in a speech.

“Zoning and other land use regulations, by restricting the supply of housing and so increasing its cost, may make it difficult for individuals to move to areas with better-paying jobs and higher-quality schools,” Furman said in his speech.

The state’s Legislative Analyst’s Office has documented how, over the last 30 years, coastal California cities, including Santa Monica and Los Angeles, have driven up housing costs by significantly restricting the amount of housing that can be built through restrictive zoning.

None of this information, however, is in either report.

It is especially discouraging to see in the primary Housing Commission report that one suggested strategy for raising funds for affordable housing — an increase in the cost of permit fees for new construction — could potentially discourage new housing growth.

“Presuming large scale development continues forward only minimally affected by these [increased permit] fees, at least we will have concurrently developed funding mechanisms which ensure the continued provision of some affordable housing, a more desirable jobs-housing balance, and presumably some reduction of inter-city commutes and their corresponding impact on our traffic flows. And if in fact these measures did act to slow development, the people of Santa Monica would likely not object to a reduction in the rate of commercial and multifamily growth in our City,” the report reads on page 5.

Neither report discusses the issue of expanding supply of housing overall as a way to relieve pressure on existing rent controlled stock or as a means of slowing down the rate of market rate rent increases.

The primary report does bring up the possibility of redeveloping strip malls on boulevards into housing, but only in the context of city-funded nonprofit housing construction. The Soloff report brings up the possibility of accessory dwelling units (ADUs, or granny flats), but only if they are rented below market rate rents. While state law allows the construction of ADUs, parking requirements currently make them cost-prohibitive, but increasingly, the encouragement of ADUs is seen as a way of adding to the housing stock in low-rise neighborhoods.

The question is, will Santa Monica’s City Council, which will ultimately decide which policies to pursue, pay more attention to national and state discussions around these issues when they eventually decide how to move forward?