Throughout the world, residents demand services and cities need revenues to provide those services. Though it’s 78th in the state by population, Santa Monica provides a higher level of city services than most cities in California, from a low-cost fitness room to a 5-star library to a class 1 fire department. Each of these services costs money, and Santa Monica is fortunate enough to be able raise revenues to provide this high level of services while maintaining a best-in-state bond rating. Those who manage municipal finances in California will tell you this is no small feat.

But how does the city assure sufficient revenues to pay for the services residents demand? Before answer this question, there are two nuances one must know about California local municipal finance.

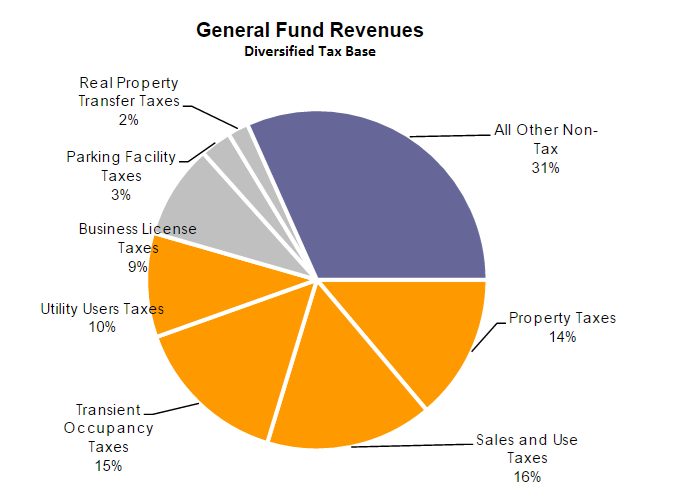

First, most of the money people pay in property taxes and sales taxes do not go to the City of Santa Monica. Only about 15% of sales taxes and 14% of property taxes stay with the city. By contrast, the entirety of the hotel tax (14% of every room charge), Utility User tax (10% on each utility bill) building license tax, and parking facility tax (10% of the parking fee) stay within the city. For an explanation of why such a small percentage of property taxes go to the city, see this new California Legislative Analyst’s Office report on Proposition 13 and property taxes.

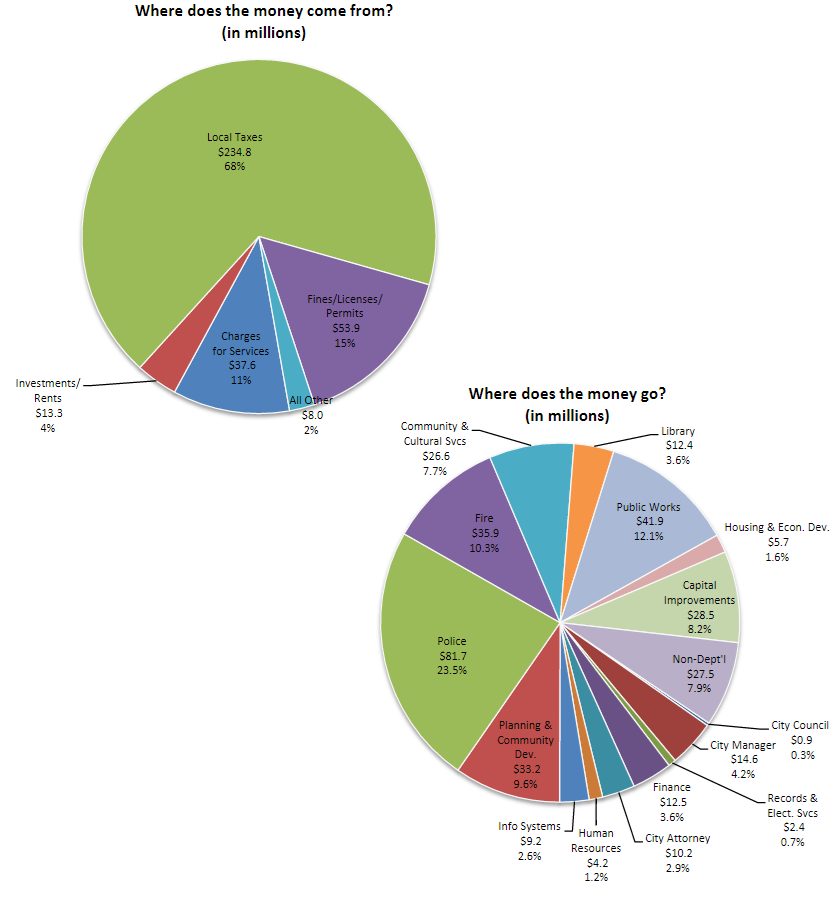

Second, the city’s finances are separated into two types of funds: special funds and the General Fund. Many special funds have restricted revenues that can only be used for specified purposes, including clean water or buying transit buses. Special funds can be enterprise funds which charge for services (for example, our water, sewer, and trash/recycling services), or earmarked funds from the state or federal government. The General Fund is the most flexible can be used for everything from libraries to police to litigation with the Federal Aviation Administration.

Breaking down General Fund revenues even further, we can see the sources where this money comes from.

Planning and development play a critical role in assuring the city’s tax base can pay for an increasing demand for city services. All of these taxes require a certain land use to generate them. Property tax isn’t generated from public facilities or churches. Business taxes are generated from buildings zoned for office and commercial. Sales taxes come from stores and restaurants. The transient-occupancy tax comes from overnight stays at Santa Monica’s motels and hotels.

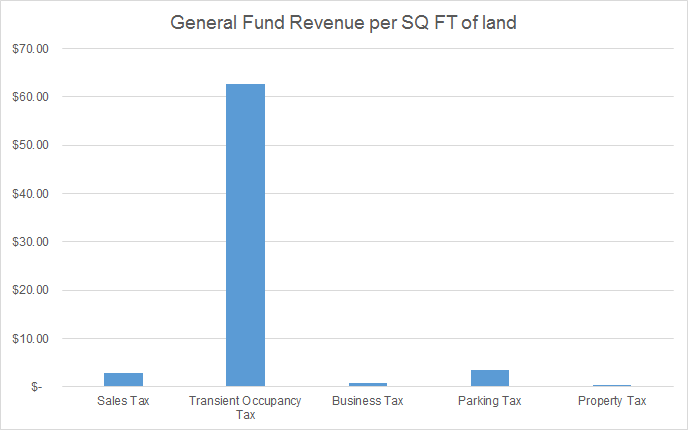

But how efficient is each of these land uses and tax types in generating money to pay for city services? I downloaded data on parcel uses from the Los Angeles County Assessor’s Office and then correlated it with the City’s publicly-available financial information.

As it turns out, on average, a square foot of land devoted to hotels and motels generates substantially more local tax revenues than any other land use.

| Name | 2015-16 Revenue Amount | General fund Revenue per SQ FT of Land |

|---|---|---|

| Sales Tax | $51,089,716 | $2.85 |

| Transient Occupancy Tax | $47,628,525

|

$62.73 |

| Business Tax | $31,468,959 | $0.78 |

| Parking Tax | $11,071,958 | $3.47 |

| Property Tax | $55,044,307 | $0.36 |

Only 0.32% of the city’s land area is devoted to hotels and motels, but this land produces 18.7% of General Fund’s tax revenues. 7.65% of the city’s land area is devoted to uses which can generate sales taxes. This land produces 20.0% of the city’s general fund tax revenue. 64.9% of the city’s land area is devoted to uses which generate property taxes, including residences, businesses, and even hotels. Property taxes on this land produces only 21.6% of the general fund tax revenues.

A 14% transient occupancy tax isn’t chump change, especially combined with the high rates at some Santa Monica hotels. A 2-night stay at the beach-side Loews hotel over Labor Day weekend would run $1,238.72, with $148.72 in transient occupancy taxes going to the City of Santa Monica. In fact, over a month, a single hotel room can generate as much city taxes as a house assessed at $1.3 million. When someone tells you that Santa Monica has sold out to tourists over the residents, just remember that we’re taking a sizeable chunk from their wallets while they’re here.

Because $62.73 per square foot of land is the average across all hotel and motel properties in the city, a new hotel with above-average rates and greater density would produce city revenues at a far higher rate per square foot of land