The Santa Monica City Council will set budget priorities this Saturday at 9 a.m. at the Santa Monica Library. The city forms its operating budget every 2 years, and the 2025-27 budget will be contentious because the city faces a large, continuing budget deficit.

This post describes the city’s budget process and fiscal situation, with an emphasis on sources and uses of revenue for voter-approved taxes for education and safe streets. I use excerpts from the city’s recent budget presentation and add some commentary on trends. Fewer than 30 people attended the city’s budget community meetings, which I don’t think reflects the importance of the decisions that our community’s leaders will make over the next 4 months.

The Budget Process

Santa Monica has two budgets:

| Budget Type | When Adopted |

| Operating budget that pays for staff and day-to-day expenditures | Odd years (25, 27, 29) |

| Capital budget for investment in infrastructure, assets, and equipment | Even years (26, 28, 30) |

Between now and June 24th, the city is forming, reviewing, and adopting the budget. The timeline below shows specific dates.

City Revenues

The city has 3 types of revenues:

- General fund revenues are the most flexible and can be used for any purpose the council decides

- Enterprise funds are earned from business-like activities, operating a water system, trash pickup, transit, etc. These revenues are restricted to being used for those purposes.

- Other funds revenues are from grants and special taxes and are restricted to specific purposes

The sources of revenues for the general funds are tax revenues, charges for services, and fees and fines. The city’s projects $458 million in general fund revenues for 2024-25.

Local taxes contribute to about three-fourths of general fund revenues.

Sales and transaction & use tax (sales taxes) are generated through consumption and use of goods. Though the city’s sales tax rate is 10.25%, the city only receives 2% of that revenue. Measure Y/YY (2010) and GS/GSH (2016) are each 1/2% sales taxes that were approved by Santa Monica’s voters. Because taxes that are deposited into a city’s general fund require a simple majority of votes cast to be approved and special taxes require a two-thirds majority, these taxes are deposited into the city’s general fund for use for any purpose. But voters also approved measures advising the city council of how to spend the money. By approving YY, voters advised the council that they expected at least half of the new sales tax revenues to go to fund education. By approving GS, voters advised the council that they expected half of the new tax to go to fund education and another half for affordable housing and homeless prevention.

Transient occupancy taxes are charged on both hotels (15% of room charge) and short-term rentals (17% of rental rate). The entirety of this tax stays within the city. As I wrote in 2016, these taxes produce the most revenue for the city of any type of building.

Utility users taxes are charged on electricity, water, wastewater, gas, video, and telecommunications. Business license taxes come as a fixed cost or percentage of revenues. The documentary transfer tax is an increasing source of revenue in Santa Monica due to 2022’s Measure GS, which increased fees to the city on the sale of properties over $8 million to fund education and housing/homelessness.

Paid parking is not subject to sales taxes, but rather has a special parking facilities tax. 2024’s Measure K increased this tax from 10% to 18% to “enhance public safety, create safe routes to school to protect children, lower the risk of fatal traffic accidents, and maintain other essential city services,” with an accompanying advisory vote to spend half of new funds on public safety.

Trends in City Revenues

Unfortunately for Santa Monica, most of these revenue sources are trending down or are flat.

With Santa Monica’s population being relatively stable, growth in sales taxes is dependent on purchases of goods by people from outside of Santa Monica, including tourists. Declining office occupancy (and lunch purchases) and reduced sales activity on the Promenade, and increasing levels of online shopping have combined to stop the growth of sales tax revenue in the city. While Santa Monica receives 2% of revenues from taxable sales picked up within the city, it receives less than this amount for online shopping.

Transient occupancy taxes (hotel taxes) are dependent on people staying in hotels. This revenue source increases when hotel nightly rates and occupancy are high. The pandemic and recent fires mean that this revenue source is flat as well.

Property taxes in California are stable and increase slowly over time. But less than 20% of what Santa Monicans pay in property taxes goes to the city’s budget. The balance goes to the county, schools, and special districts.

Other taxes have been in decline or flat as well. Business taxes and parking taxes are dependent on retail and office occupancy, which has declined as a result of the pandemic, reduced retail activity, and remote work trends.

Parking revenues have been declining for years due to increasing use of Uber and Lyft, but have further declined due to reduced office occupancy and visitation.

The utility users tax is not charged on internet or on-demand streaming services.

The Documentary Transfer tax will trend up in the future as the city receives more Measure GS funds.

City Expenditures

This section will look only at general fund expenditures because the city has the most discretion over these expenditures. As with most cities, public safety is the largest expense category.

Police, public works, and fire are the top 3 departments by expenditures:

Trends in City Expenditures

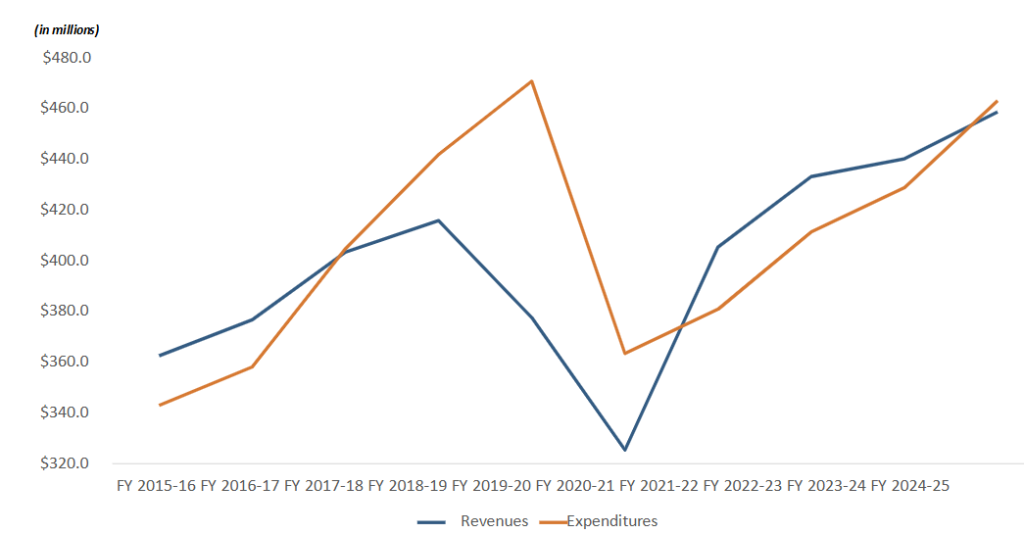

Covid-19 and the resulting reduction in tourism, increases in in-person office work, and shift to online shopping substantially reduced general fund revenues in Santa Monica. The city cut 24% of its workforce in the early days of the Pandemic but still needed to draw from reserves to cover expenses, which have included $230 million in payouts to victims of abuse by a former police department employee.

Costs to provide city services have also increased with inflation.

If you’re intrigued by the city’s financial situation, you can review the full presentation slides, watch the video, or spend your Saturday morning at the Library’s multipurpose room.

With revenues slowing and expenditures increasing, this is the second most constrained budgeting year in the past decade, after the 2020-21 pandemic adjustments. I will share more analysis of city revenues, expenditures, and budgeting processes in a future column. If you’d rather not wait on me to see some analysis, check out the 2018 outside accountant report on compensation and staffing or read the staff report for the Council’s budget study session.